Considering the ever-increasing competition for admission, rising costs, growing national student debt, and current workforce trends, it’s no wonder the question of ‘Is college worth it?’ is more relevant than ever. A college education may not be right for every student, but for others, it’s the best choice for achieving their career goals. If you’re considering pursuing a college education but feel uncertain about the return on investment (ROI), keep reading.

The Rising Question of College’s Value

Historically, a college degree was viewed as an automatic ticket to career success and financial stability. However, today’s students and families are examining the value of college more closely than ever. The shift in public perception toward the value of college is driven by several socio-economic factors:

- Soaring college tuition costs and student debt.

- The shifting job market and current employer expectations.

- The availability of alternative career pathways.

Of these factors, the financial impact of college is the most significant. As with any other substantial investment, students and families must consider if the ROI of college is worth the price tag. Student loan payments can last for years, so pursuing a college degree is not a decision to take lightly.

The True Cost of College: A Comprehensive Overview

According to the Education Data Initiative, the average cost per year to attend a U.S. college is just over $38,000, which includes daily living expenses, books, and supplies. If you factor in lost potential income and student loan interest, four years of undergraduate studies can add up to more than $500,000 — and the costs are only getting higher. While many colleges award generous financial aid, a six-figure price tag for a bachelor’s degree makes a positive ROI far from guaranteed for some majors and institutions.

Couple the rising costs with concerns about student loan debt. The Education Data Initiative reports that the average student loan debt in the U.S. is $39,075 per borrower. With interest, a student loan may take close to 20 years to pay off. Strategies to mitigate this debt often include prioritizing financial aid packages over school prestige, especially if the financial aid does not need to be paid back.

The academic and career landscapes have changed because of college costs. More students are choosing majors with historically high ROIs, such as STEM — making careers in those fields highly competitive. Other majors that offer less earning potential, like education and those in the liberal arts, are seeing sharp declines in enrollment.

Benefits of a College Degree: Beyond the Price Tag

So, given these concerns, why is college important? Earning a degree still has many benefits that can make it worth the cost, as recent college education statistics show.

Career Advancement and Lifetime Earnings

The proof is in the data — college graduate salaries are higher and unemployment rates are lower than for workers with no degree. A 2024 survey conducted by the U.S. Bureau of Labor Statistics shows a clear correlation between education level and earnings, as shown in this table.

Those hoping to pursue professional and management occupations typically need a bachelor’s degree for entry. In many industries, having a bachelor’s degree is a minimum qualification to advance into leadership roles. Additionally, a college education provides both the hard and soft skills that employers value, including specialized knowledge, technical proficiency, critical thinking, problem solving, communication, time management, and discipline.

Personal Benefits

While the financial and professional benefits of earning a college degree are substantial, there are many non-monetary benefits as well:

- Intellectual curiosity: College promotes a broader worldview by exposing students to diverse ideas, cultures, and subjects outside their major.

- Self-discovery: The college experience is a period of significant personal development, helping individuals define their values, interests, and passions.

- Increased confidence: The act of setting and achieving a demanding goal like a four-year degree builds a lasting sense of self-confidence and self-esteem.

- Higher job satisfaction: College graduates generally report higher job satisfaction, often viewing their work as a fulfilling career that aligns with their interests, rather than just a means of earning a living.

- Networking: College provides a critical opportunity to build a professional and social network of peers, professors, and alumni that can provide lifelong support, mentorship, and career opportunities.

- Civic participation: According to a recent Lumina-Gallup study, college graduates exhibit higher rates of civic engagement. They are more likely to volunteer in their communities and donate to charities than those with less education.

- Improved health: The same Lumina-Gallup study showed that bachelor’s degree holders are more likely to be in very good to excellent health than those with no higher education.

Comparing Paths: College vs. Trade School vs. Alternative Education

Gone are the days when a traditional college education was believed to be the best pathway to a good career. Trade schools, vocational training programs, apprenticeships, and skills-based certifications — especially in tech — offer lower-cost, quicker routes to employment. Check out this side-by-side comparison.

We’ve already talked about some of the advantages and disadvantages of a college education. Let’s take a closer look at some alternative pathways to a good job.

Alternative Career Pathways

Trade careers offer clear and lucrative paths for growth. In fields like electrical work and plumbing, for example, an apprenticeship is the key to advancement. However, many choose to attend trade school for foundational knowledge before starting an apprenticeship. One of the trade school benefits is that you can acquire basic credentials more quickly, which can make you more competitive for an apprenticeship or entry-level job.

Many trade professionals leverage their practical expertise to start their own businesses (e.g., a plumbing, HVAC, or construction company), giving them uncapped earning potential. Experienced tradespeople are often promoted into supervisory, project management, or operations roles where their technical knowledge is essential for overseeing teams and budgets.

Alternative education, such as bootcamps or specialized online certifications (e.g., in coding, cybersecurity, or data science), often provide a faster route to highly marketable skills than a traditional degree, leading directly to higher-paying technical roles. These certifications serve as a direct, universally recognized proof of expertise in a specific platform or methodology, often qualifying individuals for immediate employment in high-demand tech and data roles.

Navigating Student Debt: Strategies and Solutions

If you see the value of a college degree but are concerned about going into debt, the goal is to find as many financial aid options as possible that don’t require repayment so you can minimize the amount you need to borrow. This requires strategic planning before and during college.

Here are some tips:

- File your FAFSA and CSS Profile as early as possible, since some funding is first come, first served.

- Search for local, community, religious, and hobby-specific scholarships, which often have fewer applicants.

- Complete your core (general education) credits at a community college and then transfer to a four-year university. This can save tens of thousands of dollars on tuition.

- Maximize high school Advanced Placement (AP) or International Baccalaureate (IB) exams or take the College-Level Examination Program (CLEP) tests to earn credit for introductory courses, allowing you to skip classes and save on tuition and fees.

If you must take out loans for college, borrow only what you need — in other words, what is required to cover tuition, fees, and basic living expenses. You are under no obligation to borrow the maximum amount you are offered. Additionally, use private loans only as a last resort since they tend to have higher, variable interest rates and fewer consumer protections than federal student loans.

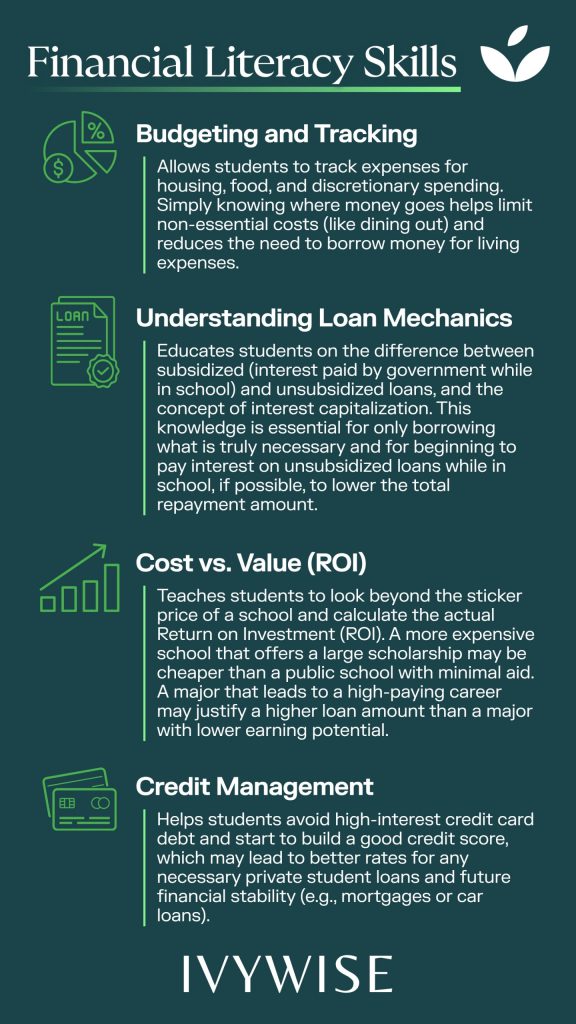

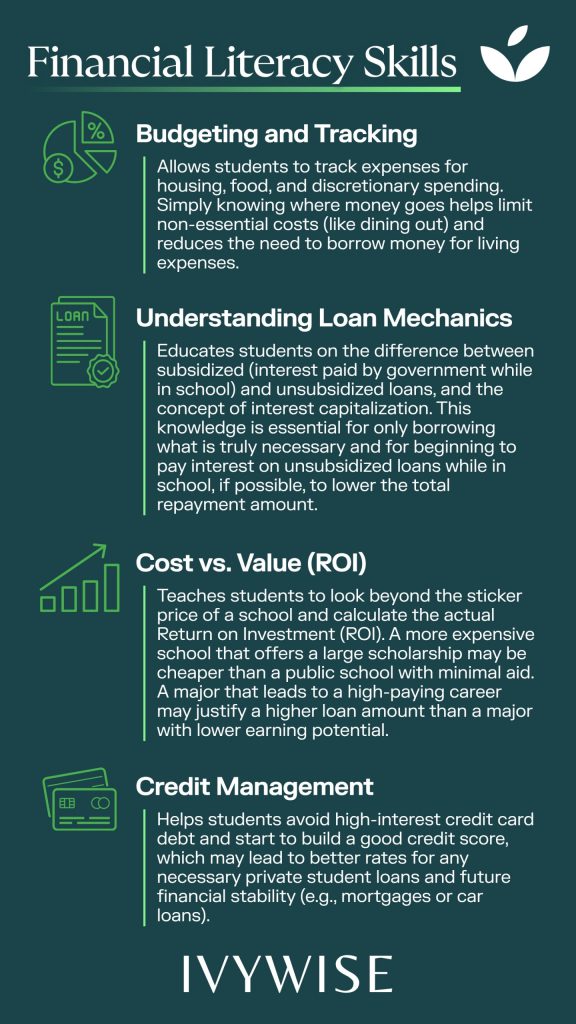

The Importance of Financial Literacy

Ultimately, financial literacy is the most powerful tool for making college affordable, managing student loans, and avoiding excessive debt. A strong understanding of personal finance empowers you to treat college as an investment decision, which ensures you graduate with a degree and an affordable debt load instead of a financial burden.

The Impact of College Education on the Job Market

Another reason for the college value debate has to do with emerging trends in employer expectations regarding higher education. While a bachelor’s degree is still the minimum education required in many fields, more companies are re-evaluating or removing bachelor’s degree requirements for some roles to prioritize a candidate’s proven competencies, certifications, and relevant work experience. Tools like micro-credentials and digital badges are becoming recognized forms of verifiable expertise.

But this doesn’t mean college should be ruled out. Many institutions are pivoting toward programs that include experiential learning opportunities, allowing students to graduate with job-ready skills. According to the National Association of Colleges and Employers (NACE), college graduates who participated in experiential learning — such as internships and co-op programs — reported higher average salaries and more career fulfillment than those who did not engage in such opportunities.

Reaffirming the Value of College in the Modern Era

Despite rising costs and shifting employer expectations, a college education remains a valuable investment for many students due to the financial stability and personal benefits it offers. Students hoping to maximize the value of their college education should prioritize programs that offer experiential learning, focus on developing in-demand skills, and earn micro-credentials or digital badges alongside their degree. It’s also important to take advantage of the campus career center as early as possible for resume review, interview practice, and networking events. Students should also build and leverage a professional network while they’re still in college.

At IvyWise, we help college students make the most of their undergraduate experience, so they not only succeed academically but they also graduate on time and are ready for whatever comes next. If you’re looking for a bigger return on your investment, our academic advising services can help.

Get Started